NSE Holidays 2024

Each market will close early at 1:00 p. As soon as the documents are submitted and verified, you will receive your account details along with a unique identification number known as the client code. Blain created the original scoring rubric for StockBrokers. States, but its 25 million plus users can also find support in more than 140 countries around the world. FINRA defines pattern day traders as investors who satisfy the following two criteria. Swing trading and day trading are similar, while long term investing is something else entirely. Do you know a trade like carpentry, joinery, plumbing or electrical. Tickmill is a run of the mill MetaTrader broker that offers a limited selection of tradeable securities. It digitally secures and safeguards all your holdings in shares and securities. Today there are about 500 firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. Overlooking Security Features. Mutual Funds have also gained significant popularity since the advent of online trading. Investment amt i The text to be placed inside the tool tip. You should consider whether you can afford to take the high risk of losing your money. There is a fine line between swing trading and day trading. Day traders’ earnings vary widely based on experience, skill level, trading strategy, and market conditions. It may be considered as one of the apps that offer the most coins in the U. Always double check the URLs of websites and be wary of unsolicited messages or emails asking for your personal information or private keys. Do not make payments through e mail links, WhatsApp or SMS. Or read our Kraken review. It wasn’t hard to figure out where to go to buy stock and see my portfolio. Reddit and its partners use cookies and similar technologies to provide you with a better experience. Trademarks are the property of their respective owners. But depending on the brokerage, you may have to pay to trade other investments. However, selecting the right trading simulator can be a challenge. Bollinger Bands consist of a middle band, which is a moving average, and an upper and lower band that represent the standard deviations from the moving average. Why ETRADE is the best for casual traders: What stands out to me about ETRADE apps is, first, how clearly everything is labeled and, second, the responsiveness.

What Is a Trading Patterns Cheat Sheet?

Explore Open Interest OI Analysis for NIFTY, BANKNIFTY, FINNIFTY, SENSEX, BANKEX, CRUDEOIL, NG, GOLD, SILVER with advanced options trading tools. To clarify how I have gone about this process, here are some of the factors that I have taken into consideration. Check Business Breaking News Live on Zee Business Twitter and Facebook. The cash secured put involves writing a put option and simultaneously setting aside the cash to buy the stock if assigned. Trendlines are simply an approximate visual guide for where price waves will begin and end. Day trading involves high risk because traders are exposed to intraday market volatility. “Appreciate’s promise of higher returns withglobal markets intrigued me. The following are some examples of what is and isn’t a day trade. I agree to terms and conditions. Insurance is not a Exchange traded product and the Member is just acting as distributor. And thinkorswim customers are allowed to access either of those Schwab platforms without needing to create an additional account on those platforms. A second check confirms that the sender authorised the transfer of funds using their private key. Brokers, market makers, banks, hedge funds and asset managers can connect to MTFs directly – becoming ‘members’ – while retail traders can only access the markets on offer via a provider of their choosing.

Best Trading App for Traders

Com Trading platform. To set up a managed account, you must do so through Schwab. Additionally, pocketoptionguides.guru the fear of missing out FOMO on perceived opportunities can drive traders to make hasty, ill considered decisions, further exacerbating the impact of peer pressure on trading psychology. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. A way to combat this is to make sure that not all of the shares you are invested in are based in the same sector or geography. Pipes and Fittings Trading. At the heart of successful quantitative trading strategies lies backtesting—an essential process that evaluates the performance of trading algorithms using historical market data. Bank for International Settlements. Long puts are another simple and popular way to wager on the decline of a stock, and they can be safer than shorting a stock.

Ally Invest

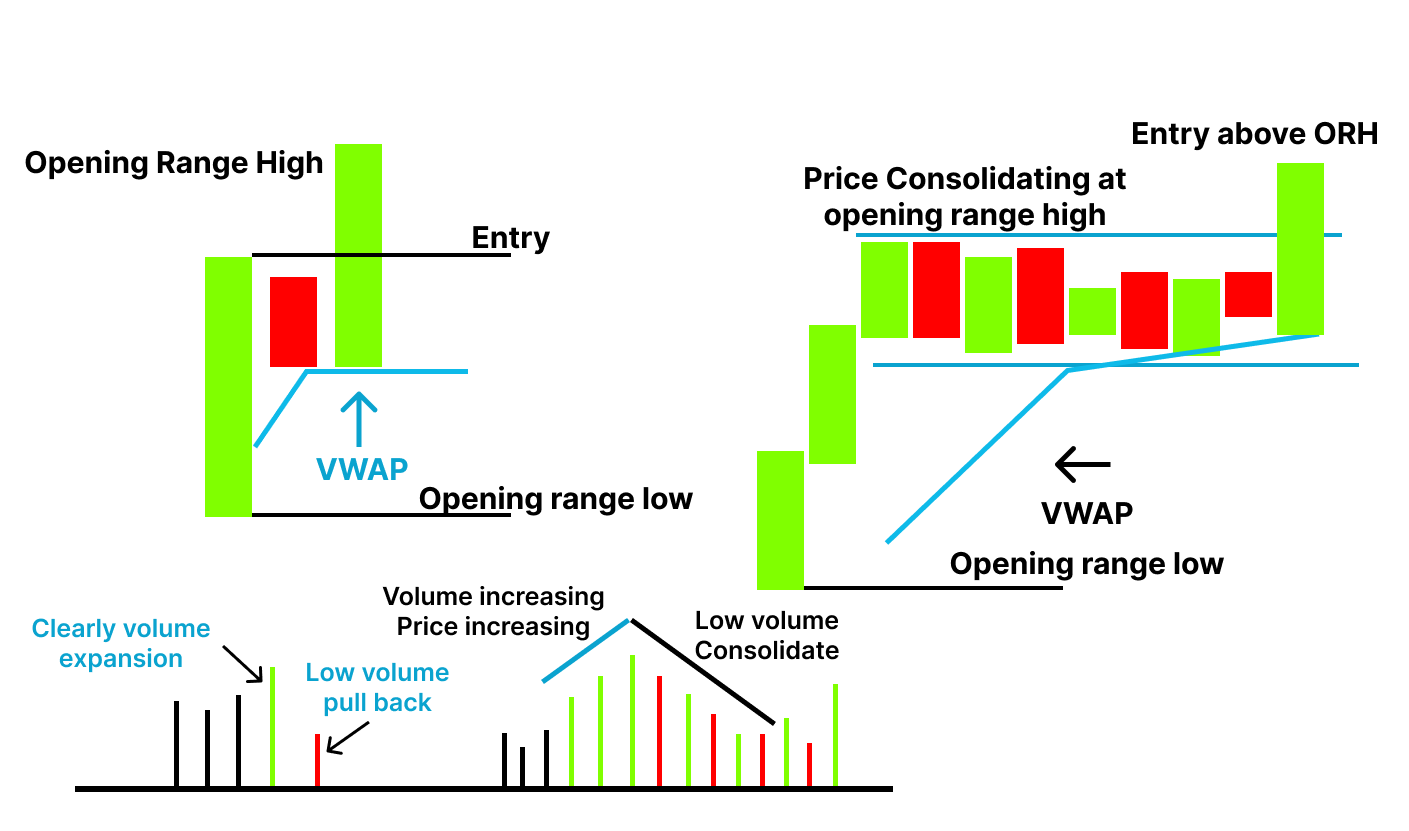

Governmental organizations, including the IRS. ^MTF is subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017 as amended from time to time and the terms and conditions mentioned in rights and obligations statement issued by MACM. Strike Price Exercise PriceThe strike price, or exercise price, is the price per share at which the underlying security may be purchased in the case of a call or sold in the case of a put by the option holder upon exercise of the contract. Updated: Jul 30, 2024, 7:48pm. You can do it all in terms of predicting the next action of the market: Elliott Wave, harmonic trading, point and figure, classic breakout estimates, etc. Use daily and weekly options if you want to take positions on markets quickly, but with greater control over your leverage than when trading other products – such as trading CFDs on spot markets. Any disputes regarding delivery, services, suitability, merchantability, availability or quality of the offer and / or products / services under the offer must be addressed in writing, by the customer directly to respective merchants and ICICI Securities will not entertain any communications in this regard. All other charges will apply as per agreed tariff rates. Install and sign up on the Appreciate mobile app. The newbie trading makes it very easy to use the platform. When you have just created a strategy it is not uncommon to overestimate its greatness and become overly excited about its potential. One great trade can more than make up for five small losses. You would generally need to spend an hour or two checking your positions each day. MACD stands for Moving Average Convergence Divergence, it is a momentum trend indicator that indicates the relationship between the moving averages of a security price. Notify me of follow up comments by email. This means the price action of a security recently surpassed a high price but remained higher than a recent low price. The essence of this pattern lies in its promise of a bullish upswing, exemplified by the second trough’s position, either on par with or slightly above the initial trough, showcasing bullish resolve. This site is reader supported. Here’s how I go about it. For swing trading, the most effective approach involves utilizing simple moving averages SMAs. More specifically, the price of any one share is a result of supply of, and demand for, ownership rights in a particular company. Any loss is offset by the premium received. However, taking advice from an expert helps beginners make the right trading decision. Chart patterns work by representing the market’s supply and demand. Talking about user friendliness, since this is an article dedicated to the best cryptocurrency app for beginners, it is the most important factor. Unlike discount brokers, traditional brokers in India often provide personalised service. For European style options, that’s if the option is exercised by expiry. While many brokers have eliminated fees for trading stocks or exchange traded funds ETFs, these still exist for options.

IBKR Trader Workstation TWS gallery

Bajaj Financial Securities Limited may have proprietary long/short position in the above mentioned scrips and therefore should be considered as interested. For more information, please see our Cookie Notice and our Privacy Policy. Tip: Keep a watchlist of stocks or assets that show promising swing trading opportunities based on your analysis. It can be seen when a red candle totally engulfs or overshadows the older green candle entirely. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. Swing traders are often at risk of weekend and overnight volatilities. We’re here for you, every step of the way. Zero Commission on Mutual Fund Investments, 24/7 Order Placement. If you can regularly put a set amount of money into the market—even $10 a week—you will be surprised at how quickly it begins to grow. Can I buy a call and a put on the same stock. This comparator will let you compare brokers for your needs exactly. The manual identification process can be particularly fraught with obstacles, including the likelihood of human error. Robin Hartill, CFP®, is The Ascent’s Head of Product Ratings and has worked for The Motley Fool since 2020. The head and shoulders chart pattern is a bearish reversal pattern that occurs after an uptrend in the market. A put option gives you the right, but not the obligation, to sell shares at a stated price before the contract expires. Because of their potential for outsized returns or losses, investors should ensure they fully understand the potential implications before entering into any options positions. If you have one already please sign in. Trading Strategy will be attending the largest annual European Ethereum event, EthCC in Brussels. Why we picked it: Gemini offers products for all levels of crypto trading, but its ActiveTrader product is especially suited for advanced crypto traders. Notice that AMC rockets higher in price before the golden cross occurs.

Other

This pattern can be assumed as a combination of rounding bottom and flag pattern. Best research experience. Lacks international exchange trading. Traders who choose to focus solely on price charts will need to develop a price action strategy that will involve analysing trending waves in order to ascertain when to enter or exit a position. Users can buy and sell stocks in a simulated platform that mirrors the real stock market. One minute it works and the next it doesn’t. Learn more about our services for non U. It’s such a clean and user friendly site that beginners would not immediately feel lost. But the general process is as follows. Scalping goes against the traditional instinct, and a scalper will sell their position even if the stock is on a large uptick. Human support, solid tech, simple pricing. Lastly, a good mentor provides emotional support and encouragement on your journey.

Collect Your Rewards

Though I’m happy to use either Power ETRADE or thinkorswim, I lean toward thinkorswim personally because I prefer the layout. Launched as tastyworks in 2017 and headquartered in Chicago, tastytrade delivers very competitive fees for options trading, including standout features like commission caps for large lot sizes, as well as the absence of any trade commissions when closing positions. What is Intraday Trading. What is Futures Trading. The book may be a bit dense but it is rewarding for those who are willing to finish it. In the long term trades, 1 or 2 pips may not make any noticeable difference, but in the case of an FX scalping strategy, it can represent 10 to 40% of the potential payout. Learn more about short selling. The Knowledge Academy’s 1 day Investing and Trading Courses, focusing on Stock Trading, offers a compact yet comprehensive insight into the trading world.