Special cases For most publicly traded companies, stock offerings are made for cash. But small businesses often have more flexible arrangements to raise capital. The company spends $ 5.5 million to purchase the shares and keep them on the balance sheet. The company will be liable to the shareholders in case of the market price fall below par value.

Financial Accounting

These voting rights allow the shareholders to dictate how the company operates. For example, they can elect the board of directors and vote on a company’s policies. However, the same rights are not a part of the other types of stock that companies offer, for instance, preferred stock. However, for today, we’ll be assuming the Board at ABC Ltd has decided to repurchase Kevin’s shares as he wants to cash in and go and play golf and see the world. However, in this example, ABC and Kevin agree on a price of $18 per share (Kevin was well pleased).

- A portionof the equity section of the balance sheet just after the two stockissuances by La Cantina will reflect the Common Stock account stockissuances as shown in Figure 14.4.

- And as we’ll see, some people will be getting their money back.

- In applying to the state government as part of the initial incorporation process, company officials indicate the maximum number of capital shares they want to be able to issue.

Impact on statement of cash flows

There are different requirements for shares exchanged privately compared to when shares are traded publicly on exchanges, like the New York Stock Exchange or the London Stock Exchange. 2Many other laws have been passed over the years that have been much more effective at protecting both creditors and stockholders. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network.

Journal entries for the issuance of common shares

We would repeat the journal entries we created for the first call. So for completeness of the example, the following journal entries would be made by ABC’s accounts team. The prospectus stated that on allotment of shares, the shareholder would have 30 days to deposit the required 50 per cent of the share price. So over August, we would see the entry below prepared by ABC Ltd each time allotment money is received. We also now have to start dealing with the premium or the additional capital above par.

The debit to the bank account reflects the $400,000 ABC now has from its first call on the class A shares. And the credit to the call account can now be closed as this money is no longer due from shareholders. The debit to the bank account reflects the additional cash ABC now has from the share offering. The credit entry to the Class A Share Application reflects the liability the company also holds. And as we’ll see, some people will be getting their money back.

Summary of Journal Entries by Transaction Type

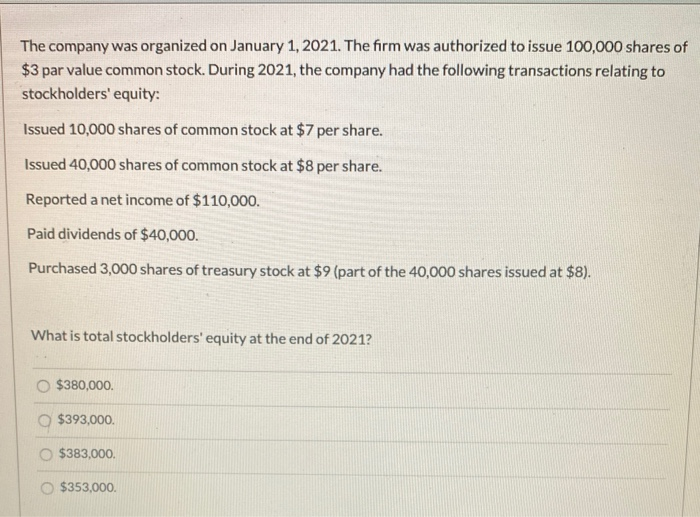

Common stock forms the basic ownership units of most corporations. The rights of the holders of common stock shares are normally set by state law but include voting for a board of directors to oversee current operations and future plans. Common stock usually has a par value although the meaning of this number has faded in importance over the decades. Upon issuance, common stock is recorded at par value with any amount received above that figure reported in an account such as capital in excess of par value.

We know we have $400,000 sitting in the application account, but how much do we allocate to share capital account and a new account, Additional Paid-in Capital. This account is also often called a Share Premium account, so you may see that in an exam. Common stock forms part of the equity section of a company – or sometimes referred to as the capital of a company.

So in July, ABC would prepare the following journal entry (we have shown the aggregate of the journal entry that ABC would have otherwise been done 20 times). The Walt Disney Company hasconsistently spent a large portion of its cash flows in buying backits own stock. According to The MotleyFool, the Walt DisneyCompany bought back 74 million shares in 2016alone. Read the Motley Foolarticle and comment on other options that WaltDisney may have had to obtain financing.

However, instead of paying cash, we give the 1,000 shares of common stock to the attorney in exchange for the service instead. The measurement of the fair value of the service in the case of issuing the common stock for the services is the same as above. So, the fair value of the shares of the common stock given up will be used as the measurement if its market value is available. However, if the fair value of the shares of the common stock giving up cannot be determined, the fair value of the service expense will be used instead. In a corporation, the common stock is usually issued for a higher value than its par value. Par value stock is a type of common or preferred stock having a nominal amount (known as par value) attached to each of its shares.

Overall, common stock is a security that represents a company’s ownership. It also establishes the relationship between the company and its owners or shareholders. On top of that, the common stock also represents the overall finance received from shareholders in accounting. In the balance sheet, debt to equity d this finance falls under the shareholders’ equity section. Before we dive into the recording process, let’s briefly understand what common stock is. Common stock represents ownership in a company and gives shareholders voting rights and a claim on a portion of the company’s assets and profits.

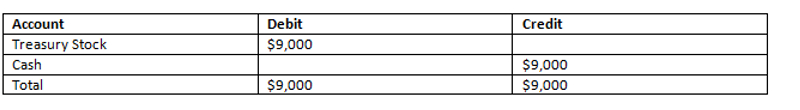

This journal entry for issuing the common stock for the $100,000 cash will increase the total assets and total equity on the balance sheet by the same amount of $100,000 as of January 1. Treasury stock transactions have no effect on the number ofshares authorized or issued. Because shares held in treasury arenot outstanding, each treasury stock transaction will impact thenumber of shares outstanding. When stock is repurchased for retirement, the stock must beremoved from the accounts so that it is not reported on the balancesheet. The balance sheet will appear as if the stock was neverissued in the first place.